Solutions

A solid tax governance framework ensures businesses meet their tax filing obligations on time. We can help you enhance your governance with a range of tech-enabled solutions, including:

Tax calendars

Book a short meeting with us to review your companies' tax profiles, and we will instantly generate a comprehensive calendar of tax obligations for each entity.

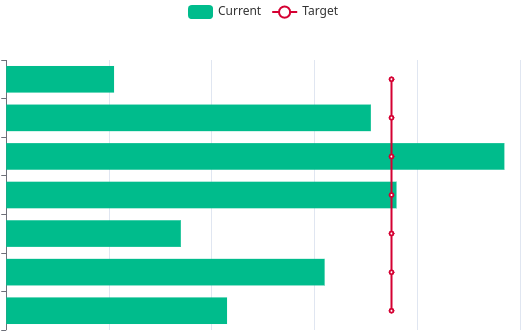

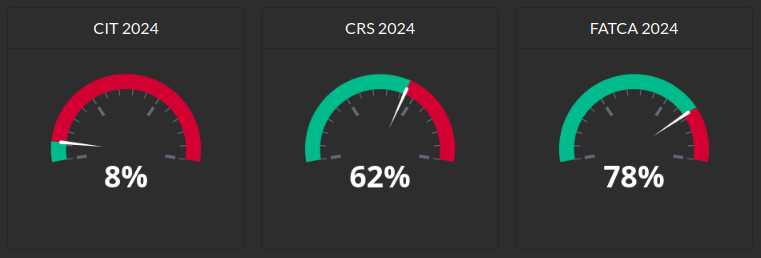

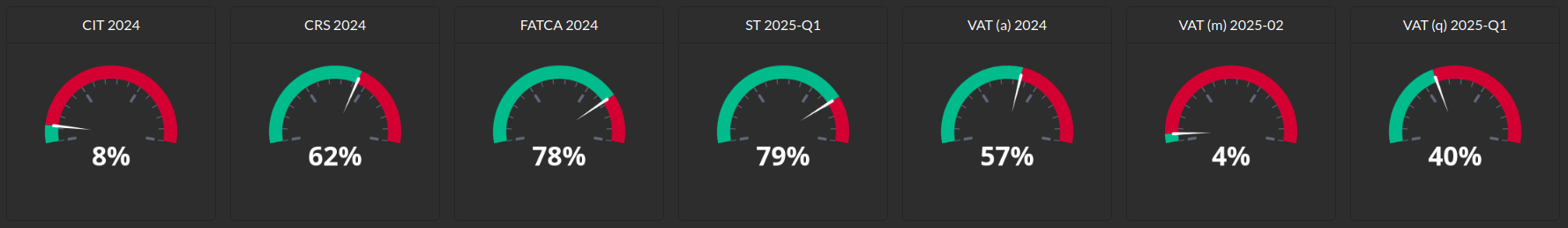

Monitoring tax filings

Say goodbye to manual spreadsheets ("trackers"): we will programmatically collect data on your tax filings and give you real-time updates on their status - no manual follow-ups required.

Processing tax correspondence

Give us just a few minutes, and we will provide you key insights extracted from the physical letters you have received from the Luxembourg tax authorities.